Macrotech IPO

What is an IPO?

Just in case you haven’t watched “The Wolf of Wall Street” 😉, IPO stands for Initial Public Offering. After a company has witnessed the Angel Investor, VC, and Private Equity Phase, it can plan to go public by offering its shares to the public, which would help the company to raise funds for reasons such as meeting CAPEX (Capital expenditure) requirements, reducing the need of financing, etc. Financing your CAPEX requirements comes with the parasite called interest, and raising your funds using IPO would help you save on this expenditure, thus increasing profits.

An IPO offers additional benefits like better visibility (otherwise, how many of us would have heard the name of Macrotech), exit opportunities for early investors, etc.

Background

Macrotech Developers Ltd. (MLD) is a Mumbai-based real estate developer who focuses on affordable and mid-income housing. It tried to go public in 2009 but dropped the plan in the aftermath of the global financial crisis. Its hopes of going public were renewed, and it tried to go public in 2018, but the plan went up in smoke because of the liquidity crisis in the real estate sector.

About MLD’s IPO

The IPO was all set to open on 7th April and end on 9th April. MLD planned to raise Rs 2500 crore from the offering and a price band of Rs. 483 – Rs. 486 was fixed. The price band tells us the range of prices within which the company will go public. Once a price band is set and a roadshow has taken place, the company will open an official window where people can subscribe to the shares by bidding a price that they deem fit for a share. The price points and the respective quantities bid by the public are collected, and the process is referred to as Book Building. The listing price is decided after the book building window is closed. This is usually the price where maximum bids have been made. The company, in its DRHP, stated, “(This) will help reduce our outstanding indebtedness, assist us in maintaining a favourable debt-equity ratio and enable utilisation of some additional amount from our internal accruals for further investment in business growth and expansion. Besides, we believe that since our debt-equity ratio will improve significantly, it will enable us to raise further resources at competitive rates in the future to fund potential business development opportunities and plans to grow and expand our business in the future”.

DRHP or the Draft Red Herring Prospectus is a document that contains the details about the IPO and the company, for example – the risks of the business, financial statements of the company, the size of IPO, management details, etc. This document is circulated among the public, who could then make an informed decision. Drafting a prospectus, doing roadshows, deciding a price band, book building exercise, and due diligence is not something that a company can handle independently. Hence, Book Running Lead Managers (BRLM)/Merchant Bankers are hired by a company to take care of these processes. MDL has engaged ten BRLMs, including JP Morgan and Axis Capital.

Current Financials of the company

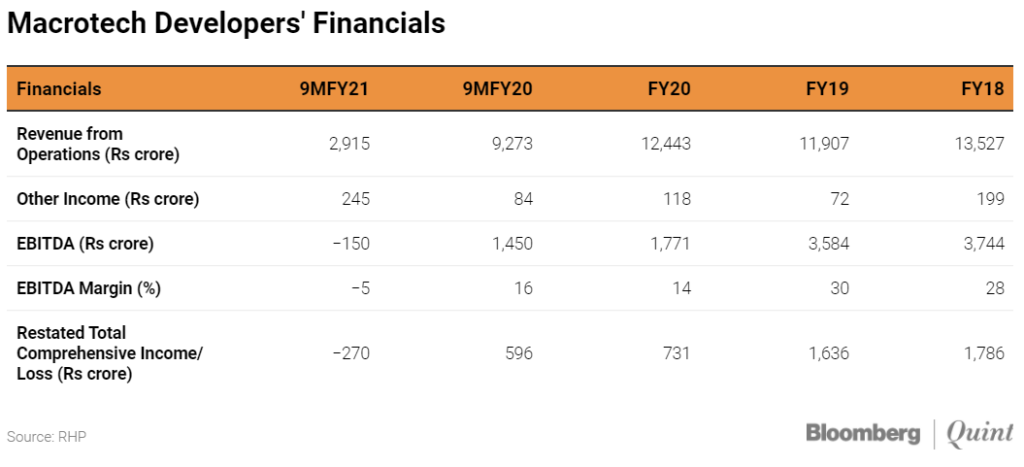

Macrotech developers have not declared any dividends in the last four financial years and have reported a loss of Rs 270 crore in the nine months ended December.

Response to the IPO

The IPO witnessed a tepid response and was oversubscribed 1.4 times. It means that the number of bids was 1.4 times the number of shares.

This kind of response is reasonable since the company has large borrowings, and the second wave of coronavirus has already hurt the investor sentiment. As an article in Bloomberg notes – “A large portion of its affordable housing portfolio qualifies for tax benefits such as 100% deduction of tax on profit (subject to minimum alternate tax) and lower GST on affordable housing. If the government amends the criteria for affordable housing or reduces or withdraws tax benefits and other incentives, a business may be adversely affected.”, which tells us about the risks associated with the business.